Transform To

A BETTER

Transform to

A BETTER FUTURE

CONTENT

2

Chairman’s Statement

6

Management Discussion and Analysis

8

Review of Operations

12

Environmental, Social and Governance Report

26

Board of Directors and Senior Management

30

Corporate Governance Report

38

Report of the Directors

47

Report of the Independent Auditor

53

Consolidated Statement of Profit or Loss

54

Consolidated Statement of Profit or Loss and

Other Comprehensive Income

55

Consolidated Statement of Financial Position

56

Consolidated Statement of Changes in Equity

57

Consolidated Cash Flow Statement

58

Notes to the Financial Statements

98

Five Year Summary

99

Properties Held by the Group

Mr. Yao Xiangjun

Chairman

Chairman‘s Statement

On behalf of BOE Varitronix Limited

(the “Company”) and its subsidiaries

(“BOEVx” or the “Group”), I present

the results for the full year ended 31

December 2017.

During the year under review, revenue of HK$2,879

million was recorded, an increase of 28% when

compared with the HK$2,247 million recorded in 2016.

EBITDA

1of the Group was HK$120 million, 19% lower

than the HK$149 million recorded for the same period in

the previous year. The profit attributable to shareholders

of HK$22 million was recorded, a decrease of 57%, when

compared with the HK$51 million recorded in 2016.

As at 31 December 2017, the cash and fixed deposits

balance of the Group was HK$1,203 million, compared

to HK$1,725 million at the end of 2016. The gearing

ratio, being total bank loans over net assets, was nil as at

31 December 2017, compared to 0.3% in the previous

year.

DIVIDENDS

The Board of Directors (the “Board”) has recommended

a final dividend of 1.0 HK cent per share (2016: 2.5 HK

cents per share). The annual dividend payout ratio was

33% (2016: 30%).

BUSINESS REVIEW

During the year under review, the Group continued to

obtain stable supply of Thin Film Transistor (“TFT”) panels

from its major shareholder, BOE Technology Group Co.,

Ltd (“BOE”), which facilitated the Group to acquire the

orders of automotive displays from customers in Europe

and the People’s Republic of China (the “PRC”), and

contributed to the rapid growth in the TFT modules

sales. Meanwhile, as the average selling price of TFT

module products was higher than those of monochrome

displays, and the proportion of medium-to-large-sized

TFT modules products increased in the sales orders mix,

the average selling price of the Group’s product mix

increased accordingly, which in turn contributed to the

growth in revenue. However, the selling prices of TFT

module products were under pressure inevitably under

the intense competition in the TFT modules market. In

addition, the Group had strived to become the major

TFT supplier of its strategic customers during the year so

as to achieve the economies of scale of production in

the future. During the initial stage of rapid development

of TFT modules business, significant investment costs

were incurred which affected the profit margin of the

orders. Besides, as the Group was currently undergoing

Highlights

HK$ million 2017 2016

Revenue 2,879 2,247

EBITDA1 120 149

Profit Attributable to Shareholders 22 51

Cash and Fixed Deposits Balance 1,203 1,725

Basic Earnings per Share 3.0 HK cents 8.4 HK cents

Total Dividend per Share 1.0 HK cent 2.5 HK cents

the transformation period of the TFT production model,

which shifted from the production of monochrome

displays and small-to-medium-sized TFT module

products to that of medium-to-large-sized TFT module

products, the Group needed to invest more resources

in technologies, staff training and equipment allocation,

thus posing pressure on the gross profit margin.

In the meantime, the working capital, including

inventories and accounts receivables, increased compared

to 2017 under the expansion of TFT modules business,

as the selling prices of TFT modules were much higher

than those of monochrome displays. The net proceeds of

approximately HK$1,392 million from the Subscription

has been utilized in the manner that is consistent with the

intended use of proceeds of the Subscription as disclosed

in the circular of the Company dated 22 March 2016.

Automotive Display Business

For the year under review, the automotive display business

generated revenue of HK$2,048 million, an increase of

38% from the revenue of HK$1,487 million recorded in

2016. This business represented approximately 71% of

the Group’s overall revenue.

During the year, TFT modules orders from automobile

customers in Europe and the PRC increased significantly.

The revenue from Europe increased by approximately

38% as compared to the previous year. The European

strategic customers gained confidence of stable TFT panel

supply of the Group which placed significant size of TFT

modules orders, especially the medium-to-large-sized

TFT modules orders. However, during the initial stage,

the Group needed to invest more resources to cope the

production demand of these orders, thus resulting in the

is still a certain demand of monochrome automotive

display from the PRC automobile customers, both the

sales volume and selling prices shown a declining trend.

The Group will continue to optimize the costs structure

in order to stabilize the margin contribution of these

business to the Group.

During the year under review, the revenue from South

Korea market increased by approximately 16% as

compared to 2016. As TFT module products were

extensively adopted by automobile customers in

South Korea and were expected to be adopted by

monochrome display customers upon the expiry of their

order contracts. There would be minimal orders of the

monochrome displays from South Korea. In the first half

of 2017, the TFT modules business was affected due to

intense relationship between the PRC and South Korea.

As the intense relationship has been moderated in the

fourth quarter of 2017, the TFT modules business has

gradually recovered.

During the year under review, the monochrome

automotive displays business of Japan has achieved

significant growth. Revenue of monochrome displays

from the automobile market in Japan increased by 37%

during the year as compared to the previous year. After

years of operation, the Group has a solid automobile

customer base in Japan which benefit the growth of

monochrome displays business. In the meantime, the

local sales team in Japan had further strengthened

with certain Japanese customers with respect to TFT

automotive displays with remarkable growth.

Industrial Display Business

Chairman‘s Statement

industrial sales. The white goods manufacturers in

Europe now prefer to install TFT modules on the white

goods in order to enhance the image and price of their

products. Given that the Group secured a stable supply

of TFT panel, white goods manufacturers placed more

orders with us for TFT modules during the year, which

generated a continued growth of TFT industrial business.

The United States was a major market of industrial

displays, and revenue derived from this market increased

by approximately 12% as compared with that of the same

period in 2016. The fourth quarter of 2017 experienced

a gradual recovery of the sales of industrial displays in the

United States, in particular sales to the medical sector,

due to our efforts of rebalancing the business portfolio,

which contributed to an increase in our revenue.

BUSINESS OUTLOOK

Automotive Display Business

The constructive strategic partnership relationships

between automotive customers and modules suppliers

are based on the stable product supply, good quality

and product design. Currently, the Group has

established a good reputation among its targeted

automotive customers, who have showed a high level

of appreciation of the Group’s stable supply of TFT

panels. It was evidenced by an increasing inquiry of TFT

modules from automobile customers in Europe and the

commencement of mass production of certain orders

gradually in 2018. Due to the intense competition in the

TFT modules market and small scale of production, the

gross profit margin of new sales orders is thin during the

initial stage of production. The Group has developed

a development strategy based on strategic customer

based approach, aiming at securing orders of

medium-to-large-sized TFT modules with higher selling prices,

which enable us to enhance production efficiency and

cost control through the consolidation of processing

of similar orders in the production lines and centralized

procurement of materials, so as to achieve economies

of scale.

It is expected that TFT modules orders from automotive

markets in China and South Korea will continue to

increase, with medium-to-large-sized TFT modules

orders constituting the largest portion of future growth

of both markets.

The Group will mainly adopt the TFT module products

as the core development sector in the future. Although

it is expected that orders for monochrome displays will

gradually shrink, the Group will maintain this business

segment given that there are still considerable demand of

monochrome displays of Japan automotive markets. Also,

the Group can adopt monochrome displays to penetrate

the automotive emerging markets such as India and

South America. The Group will streamline the operation

of the monochrome display production lines to meet the

production requirements of various monochrome display

products and to operate in a flexible manner, in order to

further reduce our operating costs.

Industrial Display Business

The white goods manufacturers of Europe increasingly

prefer the use of TFT modules which has a huge growth

potentials. The Group will customerize the design of

TFT modules which meet the demand of white goods

manufacturers in Europe. Monochrome displays still

dominate the basic application of electricity meters and

industrial instruments of European market. The Group

will focus on the development of projects with mass

volume and strategic value in order to stabilize the

revenue and profitability of this sector by optimizing the

cost structure and production process.

The United States market has shown a sign of steady

development after certain market adjustment. The

customers of this market have also shown a stronger

interest in TFT modules products, as evidenced by the

increasing inquiry of TFT products, indicate a room of

development in the TFT markets.

Production Strategy

Technology Development

The Group has developed and manufactured cockpit

display modules designated to be used in electric cars

and autonomous vehicles. In terms of cockpit display

modules, the multi-layer display is embedded under the

windscreen. The Group has commenced several relevant

research projects in 2017, involving cockpit display

modules, anti-reflective windscreens and three-layer

displays bonded with optical adhesives. These research

projects will be gradually completed in 2018.

Research on True Colour Display for the exclusive use

on automobiles has achieved solid progress, which

showed that its colour gamut is comparable with that

of OLED displays with cost effectiveness. The Group has

also developed the Gate on Array (“GOA”) technology

applicable to automobiles. Display products adopted

the GOA technology only have an extremely narrow

boarder, and have a stronger competitive edge than LTPS

displays due to the lower production costs as a result of

less application of masks.

The Group’s research and development of touch panel

products include One Glass Metal-mesh automotive

displays, whereby the ITO is replaced with the

metal-mesh, which makes the display thinner, improves

transmitting accuracy and reduces conductive traces and

reflections. In addition, several large-sized touch panel

research projects such as Multi-layers on Cell screens, Full

In-cell Touch screens and High Dynamic Range screens

will be gradually finished in the fourth quarter of 2018.

Under the rapid development of New Energy and Smart

Internet of Vehicles (“Smart IoV”), the development

trends of common adoption of internet, automation,

ACKNOWLEDGEMENT

The Group acted as the late market player of automotive

markets of TFT modules, the gross margin was decreased

under the intense market competition, the increase in

manufacturing overheads and operating costs resulted

from the development of the TFT business. Under the

increasing competition of the TFT modules market, the

Group is essential to take proactive approach to increase

market share to secure mass production in order to

achieve economies of scale and improve gross profit

margin gradually. In order to gain more market share

of strategic customers, the Group will further invest the

TFT modules assembly lines in 2018 and strengthen its

capability of materials procurement, product design,

production technology and quality control to create

a strong base for the development. In the meantime,

investment in production facilities also acted as a solid

foundation of the Group’s future development of

automobiles system business.

Management Discussion and Analysis

REVENUE

The Group’s revenue for the year ended 31 December

2017 increased by 28% to HK$2,879 million as compared

to the previous financial year.

PROFIT FROM OPERATIONS

The profit from operations for the year ended 31

December 2017 was HK$21 million, a decrease of

HK$39 million or 65% as compared to the previous

financial year.

During the financial year 2017, the Group spent HK$213

million on research and development (“R&D”) activities,

which represented approximately 7% of the Group’s

revenue.

NET PROFIT AND DIVIDENDS

The profit attributable to shareholders for the year ended

31 December 2017 was HK$22 million, as compared to

a profit of HK$51 million in 2016.

Basic earnings per share for the year ended 31 December

2017 were 3.0 HK cents as compared to basic earnings

per share of 8.4 HK cents in the previous financial year.

During the year, the Group did not declare an interim

dividend. The Board has recommended a final dividend

of 1.0 HK cent per share for the year ended 31 December

2017, which will aggregate to HK$7 million. The total

dividend for the year amounted to 1.0 HK cent per share.

STRUCTURE OF ASSETS

As at 31 December 2017, the total assets of the Group

amounted to HK$3,470 million (2016: HK$3,174

million). At the year end, inventories increased by 78% to

HK$803 million (2016: HK$451 million) while

available-for-sale securities amounted to HK$13 million (2016:

HK$11 million).

LIQUIDITY AND FINANCIAL

RESOURCES

As at 31 December 2017, the total equity of the Group

was HK$2,802 million (2016: HK$2,732 million). The

Group’s current ratio, being the proportion of total

current assets against total current liabilities, was 4.37 as

at 31 December 2017 (2016: 6.36).

At the year end, the Group held a liquid portfolio of

HK$1,236 million (2016: HK$1,790 million) of which

HK$1,203 million (2016: HK$1,725 million) was in cash

and fixed deposits balance, HK$33 million (2016: HK$65

million) in other financial assets. The unsecured

interest-bearing bank loans amounted to HK$Nil (2016: HK$9

million). The gearing ratio (bank loans over net assets)

was Nil% (2016: 0.3%).

The Group’s inventory turnover ratio (annualised cost of

inventories over average inventories balance) for the year

was 3.9 times (2016: 3.9 times). Debtor turnover days

(trade receivables over revenue times 365) for the year

was 93 days (2016: 75 days).

CASH FLOWS

In the year under review, the Group’s cash used in

operations amounted to HK$343 million (2016 cash

generated from operations: HK$235 million). The

increase in inventories and trade and other receivables

reduced cash flow by HK$348 million and HK$336

million respectively, mainly due to increase in working

capital resulted from the expansion of TFT modules

business, as the selling price of TFT modules were higher

than those of monochrome displays.

Net cash generated from investing activities amounted to

HK$230 million (2016: net cash used in investing activities

amounted to HK$576 million). There were payments for

the purchase of fixed assets of HK$250 million (2016:

HK$68 million).

CAPITAL STRUCTURE

FOREIGN CURRENCY EXPOSURE

The Group is exposed to foreign currency risk primarily

through sales, purchases, loan receivables and bank

loans that are denominated in a currency other than

the functional currency of the operations to which they

relate. The currencies giving rise to this risk are primarily

United State dollars, Euros, Japanese Yen and Renminbi.

The Group is not engaged in the use of any financial

instruments for hedging purposes. However, the

management monitors foreign exchange exposure from

time to time and will consider hedging significant foreign

currency exposure when the need arises.

CONTINGENT LIABILITIES

As at 31 December 2017, the Company had contingent

liabilities for guarantees given to banks in respect of

banking facilities granted to certain subsidiaries, which

were utilised to the extent of HK$Nil (2016: HK$9 million).

COMMITMENTS

As at 31 December 2017, the Group had capital

commitments of HK$431 million (2016: HK$84 million),

representing the purchase of property, plant and

equipment not provided for in the financial statements.

The commitment is mainly related to the purchase of

TFT modules assembly equipments in order to cope with

the increase of TFT modules sales, which is expected to

be funded by unsecured interest-bearing bank loans.

The total future minimum lease payments under

non-cancellable operating leases for properties payable within

one year amounted to HK$7 million (2016: HK$6 million).

STAFF

As at 31 December 2017, the Group employed 5,473

The Group adopts a performance-based remuneration

policy. Salary adjustments and performance bonuses are

based on the evaluation of job performance. The aim is

to create an atmosphere that encourages top performers

and provides incentives for general employees to

improve and excel.

STAFF RETIREMENT SCHEMES

The Group principally participates in defined contribution

retirement plans. In Hong Kong, the Group participates

in the Mandatory Provident Fund Scheme operated by

independent trustees. Contribution at a fixed rate of

5% of the employee’s relevant income (the “Relevant

Income”), subject to a cap of monthly Relevant Income

of HK$30,000 per employee, are made to the scheme

and are vested immediately.

In addition, the Group also operates a Top-Up ORSO

scheme, approved by the Inland Revenue Department

under Section 87A of the Inland Revenue Ordinance,

and both the employer and the employee are required

to contribute 5% of the excess of the Relevant Income to

the scheme. It is only eligible for employees who joined

the Group on or before 30 June 2009.

The employees of the Group’s subsidiaries which operate

in the PRC are required to participate in central pension

schemes operated by the local municipal government.

The subsidiaries are required to contribute certain

percentage of the payroll costs to the central pension

schemes. The contributions are charged to the profit or

loss as they become payable in accordance with the rules

of the central pension schemes.

Review of Operations

9%

AMERICA

10%

OTHERS

44%

EUROPE

32%

THE PRC

5%

KOREA

Revenue by Geography

EUROPE

During the year under review, revenue of HK$1,257

million was generated from the display business in

Europe, an increase of 38% as compared with that in

2016. The European business contributed 44% of the

total revenue for the Group in 2017.

Automotive Display Business

In Europe, the Group recorded a significant increase of

revenue from the TFT display business. This was especially

obvious in Germany and the Czech Republic. The sales

volume of monochrome display business remained

stable in 2017 but the average selling price was still

under pressure.

flexible supply of panels as well as continuous increase

of production capacity, the Group is full of confidence

to further increase the market share of TFT modules in

Europe.

During the year under review, the sales volume of

monochrome automotive displays in Europe was similar

to that in last year while the gross profit margin was still

under pressure as a result of the continual decline of

selling prices. The Group also took various measures to

reduce the material and operating costs and improve the

production efficiency of the monochrome automotive

display business in order to stabilize the gross profit margin

of this business. As it has become an predominated trend

for the European mainstream automotive customers to

adopt the TFT modules, the Group expected that there

is still a room for decline in the sales volume from the

applicable to automobiles. Display products adopting the

GOA technology are of higher resolution and more

cost-effective. In addition, New Energy and Smart Internet

of Vehicles have rapid development in recent years.

The Group is actively striving to expand the automotive

intelligent interactive system business. During the year

under review, the Group gained certain achievements

in the research and development of Dual Optical HUD,

Smart Rear Mirror etc.

Industrial Display Business

During the year under review, the Group’s industrial

business in Europe has maintained steady development.

The revenue increased slightly as compared to that

in 2016. Most European electricity meter customers

maintained stable sales order.

Review of Operations

The white goods manufacturers in Europe increasingly

prefer to install TFT modules on the white goods in

order to enhance the image of their products. The

selling prices and gross profit margin of white goods

adopting TFT modules were higher than those adopting

monochrome displays. With a stable supply of TFT panels

and its design capability, the Group was able to meet the

requirements of white goods manufacturers in Europe.

The Group believes that it can take advantage of the

development opportunities to increase the revenue and

profit contribution of this business.

AMERICA

America generated revenue of HK$268 million in

2017, contributing 9% to the total revenue of the

Group. America’s revenue in 2017 increased by 12% as

compared with that in 2016.

Industrial display has always been a major business

segment in the America’s market. The fourth quarter

of 2017 experienced a gradual recovery of the sales

of industrial displays in the United States, in particular

in the medical sector, due to our efforts of rebalancing

the business portfolio, which contributed to an increase

in our revenue. On the industrial display business side,

medical product and point of sales (“POS”) product

sectors are still the major application areas. The sales

team has secured certain quantity of sales orders from

our key medical product and POS customers, which will

provide a stable revenue source for the Group.

In terms of automotive display business, the Group

recorded an increase in revenue as a result of the

development of the monochrome displays business

in 2017. In addition, some customers increased order

inquiries and placed some orders regarding TFT module

products. It is expected that the sales volume of TFT

module products in the America’s market will gradually

increase in 2018.

THE PRC

Revenue contributed by the PRC was HK$923 million

during the year under review, representing an increase

of 30% as compared with that in 2016. This region

accounted for approximately 32% of the Group’s total

revenue.

still form as fundamental customer base for the industrial

displays market in the PRC. During the year, the Group

has been continuously expanding the customer network

to increase the revenue of this business.

Besides, the Group’s automotive touch panel business

developed rapidly in the PRC. In order to cater for the

customers’ requirements of the thickness, resolution and

transmitting accuracy of touch panel products, the Group

is in the research and development of One Glass

Metal-mesh automotive displays to satisfy the expectations of

customers. In addition, several large-sized touch panel

research projects such as Multi-layers on Cell screens, Full

In-cell Touch screens and High Dynamic Range screens

will be gradually finished in 2018.

KOREA

Revenue generated in Korea was HK$152 million in 2017,

increased 16% compared to 2016. Korea accounted for

5% of the total revenue of the Group.

monochrome display. Despite of this, the Group won

a considerable amount of the TFT modules and touch

panel new sales orders and gradually commenced mass

production during the year under review, which partly

offset the adverse impact of drop in monochrome display

business in Korea.

However, in the first half of 2017, the TFT modules

business in this area was affected due to the intense

relationship between the PRC and Korea. Fortunately,

as the intense relationship has been moderated in the

fourth quarter of 2017, the TFT modules business has

gradually recovered. It is expected that there is still a

growth potential in revenue of the automotive TFT

modules products in 2018.

Environmental,

Social and Governance Report

The Group began incorporating its Environmental, Social

and Governance (ESG) Report into its Annual Report from

2014. This ESG Report was prepared for the year ended

31 December 2017 with reference to the ESG Reporting

Guide published by The Hong Kong Exchanges and

Clearing Limited (the “Stock Exchange”), and based on

the material aspects of the Group and stakeholders. Our

TFT modules assembly plant in Chengdu has been put in

the mass production in the fourth quarter of 2017, unless

otherwise stated, this ESG Report covers operations in

the PRC (including Heyuan and Chengdu) and Hong

Kong, which together represent the core operations of

the Group.

The Board has been closely overseeing the Group’s

initiative to make continuing ongoing improvements and

to formulate an effective reporting mechanism. BOEVx’s

ESG risk management and reporting mechanism takes

into consideration operational management and relevant

stakeholders. Assessment of ESG status and progress are

conducted on an ongoing basis.

ESG Risk Management and Reporting Mechanism

Functional Departments

Designing, implementing and monitoring riskmanagement and internal control systems in relation to ESG, taking into account the Board’s

ESG priority.

Monitoring to ensure effective implementation of ESG strategic plan, and regularly reviewing

stakeholders’ expectation on ESG matters.

ESG Risk Management Team

Recognising and prioritising stakeholders’ need and expectations in relation to ESG, and formulating strategic plan accordingly.

Board of Directors

Shareholders/Investors,regulators, customers, suppliers, community, employees

Key Stakeholder

The ESG Risk Management Team consists of top management from operations and finance, and communicates regularly to ensure ESG risks are properly managed.

ENGAGING STAKEHOLDERS

The Group communicates regularly with stakeholders through various channels in order to understand their different

expectations and the possible impacts to them of its sustainable development activities.

Stakeholders

Communication Channels

Content

Shareholders/Investors

•

Annual general meetings and notices

•

Annual/interim reports, financial statements and

announcements

•

Direct communications

•

Corporate website

•

Investor briefings

•

Business sustainability

•

Financial performance

•

Corporate transparency

•

Corporate social responsibility

Regulators

•

Meetings

•

Compliance reporting

•

Compliance with laws and

regulations

Customers

•

Direct communication via frontline staff

•

Customer audits and factory visits

•

Corporate website

•

Quality products and services,

and delivery arrangements

•

Technological developments

•

Product responsibility

•

Factory and labour conditions

Suppliers

•

Direct communication and meetings

•

Site visits and reviews

•

Vendor acceptance and management processes

•

Questionnaire

•

Sustainable procurement

•

RoHS considerations

•

Corporate reputation

•

Industry experience and

expertise

Community

•

Involvement in and meeting with various

communities through social services and sports

activities

•

Cooperation with local universities and NGOs

•

Improvement of community

environment and culture

•

Support for public welfare

activities

Employees

•

Training and development

•

Regular performance appraisals

•

Newsletters

•

Work-life balance activities

•

Policy communication

•

Health and safety

•

Remuneration and welfare

•

Career development

Environmental, Social and Governance Report

MATERIALITY ASSESSMENT

The issues that matter most to the Group’s business

and its stakeholders are identified and presented

in the materiality matrix above. The Group places

comparatively higher emphasis on ESG matters relating

to the environment, employee safety and supply chain

management as these are external stakeholders’ top

concerns, weighted against the risks and opportunities

they present to the Group. Whilst higher priority is given

to these areas, other ESG aspects are also monitored on

an ongoing basis and are included in this ESG report to

enhance corporate transparency.

ENVIRONMENT

Over years, the Group has developed streamlined

operating processes and energy-efficient hardware to

lessen energy and water utilisation, improved the use of

resources and investigated new means for environmental

preservation.

As a manufacturing company, the Group’s management

is always aware of the importance of sustainable

development and environmental protection. The

Group’s policy on emissions and waste is fully complied

with the requirements of the emission standard in

《水污染物排放限值》

(DB44/26-2001),

《大氣污

染物排放限值》

(DB44/27-2001) and other relevant

requirements and standards.

The Group has been accredited with ISO 14001 since

2005. Under this accreditation, the Group resolves

to comply with environmental laws, regulations and

other applicable requirements, and to reduce or

eliminate pollution while minimising any impact on

the environment.

The manufacturing facilities in Heyuan city and Chengdu

city are required to undergo stringent environmental

audit and continuous monitoring, in order to protect the

natural resources in the region and also to comply with

all relevant local environmental laws and regulations.

Emission and Waste Performance of Heyuan Plant

Waste

Total tonnes in 2017

Tonnes/ Revenue (HKD1,000

million) in 2017

Total tonnes in 2016

Tonnes/ Revenue (HKD1,000 million) in 2016

Total tonnes in 2015

Tonnes/ Revenue (HKD1,000 million) in 2015

Total tonnes in 2014

Tonnes/ Revenue (HKD1,000 million) in 2014

Air

HCL 2.29 0.795 3.13 1.39 2.9 1.17 3.8 1.45

Particulates 0.89 0.309 <0.065 <0.0289 <0.050 <0.0201 0.098 0.0375

SO2 0.5 0.174 <0.1630 <0.0725 <0.1544 <0.0621 <0.0737 <0.0282

NOx 2.54 0.882 0.182 0.0809 0.175 0.0703 0.172 0.0658

Oil Fumes 0.02 0.007 0.01 0.01 0.02 0.01 <0.01 <0.01

Water

Wastewater 706,387 245,358 662,863 294,999 837,897 336,775 859,906 329,088

Solid

Solid Waste

Hazardous 88.97 31 82.87 37 70 28 78 30

Solid Waste

Non-hazardous 978.29 340 915 407 574 231 685 262

Emissions

Major emissions in the production plant are primarily

collected at the exhaust vents of the production buildings

and canteen kitchen of Heyuan plant. Hydrochloric acid

is the main emission created by the production process. It

is used at the etching stage when producing LCD panels.

The volatilised hydrochloric acid is drawn to the ventilation

system in the production buildings, then transmitted to

the neutralising machines on the rooftop and neutralised

with alkali before being released to the air.

Emissions such as particulates, sulphur dioxide, nitrogen

oxide and oil fumes are collected from the exhaust

vent at the canteen kitchen of Heyuan plant. These

substances are mainly produced during the process

of fuel combustion. The increase in emissions in 2017

compared with previous years was mainly due to the

increase in the amount of food served in the canteen

in Heyuan. Environmentally clean fuel has been used

consistently since the second half of 2009, to reduce

the emission of nitrogen oxide from kitchen ventilation.

The Chengdu production plant is mainly engaged in

TFT module assembly and thus no notable emission is

generated.

Wastewater

Waste is unavoidable during the manufacturing and

operation process, but the Group keeps a stringent

control on the emission and ensures it is properly treated

to minimise any negative impact to the environment.

Wastewater generated during the manufacturing process

is treated in a large underground wastewater treatment

facility with a daily maximum treatment capacity of

4,000 cubic meters. The current actual daily treatment

is about 3,000 cubic meters. A computer software

ELECTRICITY AND WATER CONSUMPTION, AND EMISSIONS

2014 2015 2016 2017

Water Consumption per

Production Output

Water (tonne / 1,000 unit)

Chengdu Heyuan

2014 2015 2016 2017

0.07

0.06

0.05

0.04

0.03

Emissions per

Production Output

CO2 (tonne / 1,000 unit)

Heyuan

Year Year

2014 2015 2016 2017

Electricity Consumption per

Production Output

Electricity (kWh / 1,000 unit)

Chengdu Heyuan

Year

500 700 900 1,100 1,300 1,500

Environmental, Social and Governance Report

Solid Waste

Non-hazardous solid waste is usually produced during

manufacturing and daily living. Used carton boxes,

wooden packing cases and scrap glass are collected by

qualified recycling contractors. Production plant staff are

also encouraged to put rubbish into designated garbage

containers. Such collected garbage is also collected by

qualified recycling contractors.

Hazardous waste from the production area consists

primarily of materials used in the manufacturing process.

Chemicals used during production are collected and

treated in full compliance with local environmental

regulations.

Measures to Reduce Emissions

and Waste

Since 2016, the Group mitigated 2.8 tonnes (per annum)

of hazardous waste by recycling the used non-dust cloths,

classified as hazardous waste after use with alcohol,

with special treatment. Wastewater was also reduced

to 40mg/L of Chemical Oxygen Demand (COD) through

Mixed Wastewater Treatment of domestic sewage and

industrial wastewater, which is lower than the emission

standard value of 90mg/L. In 2017, an investment of

HK$936,700 in the transformation of the water loop

treatment system at the Heyuan plant which was used

to treat the waste water and recycling. It reduced the

annual discharge of 6,000 tonnes of wastewater.

The Company’s TFT Production was accredited with

the “2017 Company Electronic Control - Excellence

Team in Energy Saving and Emission Reduction” by the

Beijing Electronics Industry Trade Union. The award was

recognized for the recycling of dust-free cloth, which

has been used for cleaning the patch glass and TP visual

inspection cleaning. After unified purification in the

recycling, the dust-free cloth can be used for cleaning

the glass-hydrogel reinforced process, i.e. the epoxy

dispensing process (syringe tip and syringe cleaning),

machines, worktop, curing racks, fixtures, ovens, etc. This

contributed a saving of approximately RMB1,530,000.

Use of Resources

As a manufacturing company, electricity and water

are the resources most used during the course of

operations. Management recognises the significance

of energy conservation, and ongoing measures are in

place to reduce the use of natural resources. The Group

regularly reviews ways for the efficient use of resources

and develops improvement plans, with the aim of

further reducing consumption of these resources while

maintaining effective operation of the production plant.

However, due to the increase in production capacity of

Heyuan plant in 2017 as compared to 2016, the average

energy consumption (i.e. total electricity consumption/

total production output) was reduced.

For Chengdu plant, the electricity consumption per

production output is lower than that of Heyuan plant as

it only engages in TFT module assembly process. The

water consumption per production output in 2017 is at

a higher level, as it was not reaching full capacity during

initial stage of mass production.

At the same time, the Group strives to minimise any

impact on the environment and save material costs by

continuously reviewing the design for product packaging,

with the aim of reducing packaging size. Despite this, as

the Group’s products are glass LCD panels or modules,

they must be protected with polyfoam trays during

delivery and so the use of polyfoam trays is unavoidable.

In 2017, the quantities of carton boxes and polyfoam trays

used for product storage and transportation in Heyuan

were 1,075 tonnes and 1,148 tonnes respectively. This

indicates an increase of 15.8% and 26.6% respectively,

as compared with the year 2016. In 2017, the quantities

of carton boxes and polyfoam trays used for product

storage and transportation in Chengdu were 39 tonnes

and 74 tonnes respectively.

Energy Consumption, Water Utilisation and Packaging Material Used

Total tonnes in 2017

Tonnes/ Revenue (HKD1,000 million) in 2017

Total tonnes in 2016

Tonnes/ Revenue (HKD1,000 million) in 2016

Total tonnes in 2015

Tonnes/ Revenue (HKD1,000 million) in 2015

Total tonnes in 2014

Tonnes/ Revenue (HKD1,000 million) in 2014 Heyuan Production Plant

Electricity (kWh)

100,992,658 35,079,075 91,205,623 40,589,952 90,905,585 36,537,615 89,012,950 34,065,423

Water (Tonne)

1,362,932 473,405 1,145,386 509,740 1,414,773 568,639 1,251,385 478,907

Carton boxes (Tonne)

1,075 373 928 413 1,118 449 973 372

Polyfoam trays (Tonne)

1,148 399 907 404 999 402 825 316

Chengdu Production Plant

Electricity (kWh)

1,158,672 402,456 – – – – – –

Water (Tonne)

34,054 11,828 – – – – – –

Carton boxes (Tonne)

39 14 – – – – – –

Polyfoam trays (Tonne)

74 26 – – – – – –

Hong Kong Office

Electricity (kWh)

168,579 58,555 117,330 52,216 153,859 61,840 154,891 59,277

Water (Tonne)

108 38 96 43 88 35 90 34

Measures to Reduce Energy

Consumption and Water Utilisation

As at 31 December 2017, 1,000 T8 and T5 light bulbs

had been phased-out and replaced with LED lights.

Environmental, Social and Governance Report

Recognition

The Group received recognition for its efforts in

environmental protection in 2017. BOEVx was awarded

with the “Green Office Label” by the World Green

Organisation. The Hong Kong office was also presented

with a “Long Term Participation Award” by the HSBC

Living Business Awards Programme

1, to recognise years

of efforts on environmental protection.

SOCIAL

Employment

The Group strictly observes the labour law in Hong Kong

and the PRC. It is the policy of the Company to maintain

a working environment that complies with the Race

Discrimination Ordinance, Sex Discrimination Ordinance,

Disability Discrimination Ordinance and the Family Status

Discrimination Ordinance of the Ordinance and Code of

Practice.

The Group provides remuneration, welfare and fringe

benefits to employees comparable to the market

standard. Remuneration, salary and bonus distribution

are determined with reference to a performance-linked

scale. When it comes to annual reviews, factors such

as the Company’s financial performance, business

prospects, individual performance, market rates and

inflation rate are taken into consideration to decide the

rate and scale.

In 2017, the turnover rates for Hong Kong, the PRC and

Overseas staff were 12.5%, 29.5% and 0% respectively.

During the year, there was no significant reported case of

non-compliance with the relevant laws and regulations

in Hong Kong, the PRC and Overseas.

Health and Safety

The Group’s policy on health and safety is to comply

fully with local government regulations, as stipulated

in the law of prevention of occupational disease

《中華人民共和國職業病防治》

and fire prevention in

the PRC

《中華人民共和國消防法》

, and to maintain

a healthy and safe working environment for all

employees, including the plant and systems of work,

and to provide such information, instruction, training

and supervision as they need. The production plant in

Heyuan has successfully renewed its OHSAS18001 with

Health and Safety accreditation. The production plant in

Chengdu is accredited with its OHSAS18001 in 2017.

In 2017, there is no work-related fatality in the Group

and no injury case was reported among Hong Kong

employees. The factory recorded 35 (2016: 31) injury

cases with 563 (2016: 325) lost days due to work injuries.

Every injury case underwent a detailed review and

evaluation, with precautionary measures put in place to

avoid a repeat occurrence. Extra training was conducted

with the parties involved.

The Group understands that natural disasters and

accidents are unavoidable, and our management aims to

mitigate any damage during mishaps. An emergency and

fire drill, and fire precautionary training are conducted

once a year in both the Hong Kong office and the

production plant. First-aid training is provided to staff and

workers. Training in safe handling of chemicals is also

conducted for related workers on the production floors.

In the production plant, a patrolling team is responsible

for carrying out audits regarding workplace efficiency,

effectiveness, and safety measures.

In addition to workplace safety, a healthy lifestyle is

promoted to all employees. Talks on health & wellness and

a variety of activities related to sports and social service are

arranged for employees’ participation. The aim of these

activities is to achieve a sustainable work-life balance.

Development and Training

2017 2016 2015

Total Training Hours

Total Participants

Total Headcounts

Average Training Hours per Staff Member

Total Training Hours

Total Participants

Total Headcounts

Average Training Hours per Staff Member

Total Training Hours

Total Participants

Total Headcounts

Average Training Hours per Staff Member

HK Staff

Male 238 58 42 5.7

332 207 149 2.2 795 300 168 4.7

Female 206 70 36 5.7

PRC Staff

Male 7,008 1,398 578 12.1

5,274 2,993 770 6.8 3,173 689 699 4.5

Female 3,725 914 370 10.1

PRC Workers

Male 7,616 1,355 665 11.5

19,312 6,886 4,026 4.8 20,364 4,262 4,270 4.8

Female 20,250 5,950 3,657 5.5

Workforce and Turnover Rate

2017 2016 2015

Age Hong Kong PRC Overseas Hong Kong PRC Overseas Hong Kong PRC Overseas

Male

18 – 45 73 1,200 13 77 954 14 87 905 15

46 – 65 35 43 21 31 42 10 33 25 10

Turnover

rate 12.2% 29.5% 0% 12.7% 27.6% 0% 14% 22.7% 0%

Female

18 – 45 27 3,741 8 24 3,488 10 30 3,911 11

46 – 65 19 286 7 17 312 6 18 128 6

Turnover

rate 13.2% 29.5% 0% 18% 31.8% 11.8% 10% 19.6% 6%

Employment Type

Staff 154 948 49 149 770 40 168 699 42

Environmental, Social and Governance Report

Development and Training

The Group values its employees and is committed to

providing an ideal workplace in which its staff members

may grow and develop. In 2017, the Group conducted a

series of training sessions for staff and workers.

The Group’s policy is to ensure that all employees achieve

personal growth in their careers, and training is therefore

encouraged. This is usually held during working hours,

so that employees need not sacrifice personal time for

training. A flexible work pattern may be scheduled for

Hong Kong staff members working in the production

plant if they need to pursue further studies.

Training covers a wide range of topics including

operational skills, craftsmanship, display technology,

quality standards, environmental matters, health and

safety and soft management skills. Senior managerial

staff members are usually invited to be technical

instructors. External coaches are employed for specific

trainings on soft management skills. In 2017, external

coaches were employed to conduct an Outward Bound

training for the engineering staff. The training aims at

fostering personal development, teamwork, problem

solving, and interpersonal skills.

Labour Standards

The Group complies with and observes the respective

Labour Laws and Regulations in its operating countries.

As a responsible employer, the following principles are

strictly enforced:

•

No child labour

•

Ensure that wages comply with or exceed the minimum

legal requirements of the country where employees

are based

•

Overtime practice is based on a voluntary pattern, no

forced labour is allowed

•

Respect for the opinions of general employees and the

labour union

•

Formal complaint channels are established and are

regularly promoted to employees

•

Equal employment opportunities – employment of

disadvantaged employees and diversity and inclusion

are encouraged in the workplace

•

Harassment and abuse – these are actively discouraged

in any form, to or among all employees

•

Protection of privacy and personal data at work

All potential applicants are required to complete the

Company’s Employment Application Form, where

personal data such as, names, contact details, ID

numbers, etc. will be provided by the applicants. Human

Resources Department will then reference check the

ID cards to ensure that they meet the minimum age

standard, i.e. 18 years or above.

People Caring

The headquarters office in Hong Kong was presented

with the Certificate of Merit in the Caring for People

category in the HSBC Living Business Awards 2017. The

Award recognises the Group’s outstanding performance

in aspects of staff training and development,

communications, equal opportunity, staff welfare,

work-life balance, family-friendly practices, occupational

health & safety and supply chain management. The

Group provided all-round attention in the above areas,

and performed exceptionally well in organizing work-life

balance activities for staff and showing flexible treatment

for staff members who need special care or to cope with

family issues.

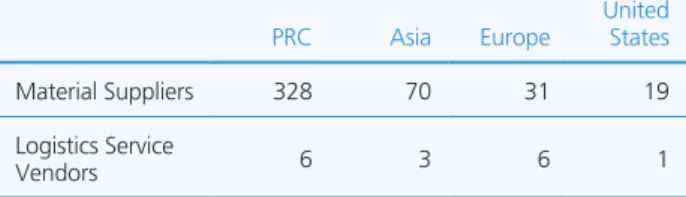

Suppliers by Geographical Region

PRC Asia Europe

United States

Material Suppliers 328 70 31 19

Logistics Service

Vendors 6 3 6 1

Supply Chain Management

The Group takes a collaborative approach to supply

chain sustainability management, as it views its suppliers

as part of an interdependent ecosystem.

In 2017, the Group took the initiative to evaluate

its suppliers’ social responsibility performance. Both

material suppliers and logistics service vendors were

included in an evaluation distribution list. Completed

questionnaires helped the Group to understand and

evaluate the performance of its suppliers and vendors in

the aspects of:

•

Work hours

•

Child labour

•

Forced labour

•

Health and safety

•

Environmental concerns

•

Corporate social responsibility

Selection and Evaluation of Suppliers

The Group selects suppliers and purchases materials

and/or services from suppliers and vendors using three

methods, namely, price comparison, bidding and sentinel

procurement. Audits of suppliers and vendors are

performed on a regular basis. Results are compiled for

review by the Supplier Quality Team and are approved by

the department head of Quality.

Criteria for audit include:

•

General operation and workforce condition

•

Quality qualification

•

Quality system training

•

Inspection procedures for quality systems

Distribution of Suppliers

Suppliers are divided into material suppliers and logistics

service vendors. Certain material suppliers are requested

to sign a declaration declaring that their packing material

and Bill of Material (BOM) contains no hazardous

substance. There was no reported case of violation of the

declaration by any of our suppliers in the reporting period.

Table of Distribution and Response Status

Number Percentage (%)

Total No. of major suppliers for

manufacturing operations 92 –

Total No. of major suppliers

questionnaires sent 92 100

Total No. of completed

Environmental, Social and Governance Report

Service Vendors

The Logistics Department screens and selects service

vendors by considering of the following factors:

•

Company background – financial stability, reputation

and global network

•

Pricing and competitiveness

•

Services – performance track record, efficiency and

customer service

•

Environmental performance – for instance, most

of vendors use trucks compliant with Euro IV and V

standards

Product Responsibility

The Group has no recall on products sold or shipped due

to safety and health reasons in 2017. There are average

117 cases and 106 cases per month of automotive

quality enquiries in 2016 and 2017.

Safety is always the core of the Group quality policy. To

pursue such policy, the Group is qualified by International

Standard: ISO 14001 and QC 080000. With these

standards, the Group has developed an intensive system,

to ensure no harmful substances (dangerous material lists

from RoHS/REACH) going into BOEVx finished goods. As

a result, there is no concerned recall in 2017 record.

As one of major automotive component suppliers, the

Group takes responsibility for providing customers

with quality and completed after-sale services. Such

responsibility covers 8-discipline reporting (8D), customer

complaint review meeting (CCR) and continuous

improvement plan (CIP). With 8D approach, the negative

impact from defects is quickly limited by containment

action (which is mostly defined in 48 hours). With weekly

CCR, “cause and action” will be fully consolidated

across departments like Production, Process and Design.

Furthermore, to achieve reject rate in PPM (parts per

million) level, CIP is carried out quarterly with the

involvement of the senior management.

The Group’s prime objective is to provide high quality

products that fully conform to their requirements and

specifications. This commitment is fundamental to all work

undertaken and is closely observed by all members of the

Group in their daily activities. All products must strictly

comply with the Group’s policy of operating a Quality

Management System that fully meets the requirements

of ISO 9001 and ISO/TS 16949 for automotive products

and customer requirements for supplementary

standards. This standard stipulates all processes from

product development to completion of production and

to after-sale services. In addition, Hazardous Substance

Process Management is in place where procedures and

related processes have been assessed and confirmed to

be compliant with QC 080000. The production plant in

Heyuan is accredited with ISO 14001, ISO 9001, ISO/TS

16949, QC 080000 and OHSAS 18001 certifications.

The production plant in Chengdu is accredited with ISO

14001, QC 080000 and OHSAS 18001 certifications. In

addition, the production plant in Chengdu has already

upgraded its ISO/TS 16949 to IATF 16949 (the latest

version). The production plant in Heyuan will also get the

IATF 16949 in June 2018.

Protection of Intellectual

Property Rights

The Group is devoted to respect the concept of

intellectual property which include but not limited to

patents, product information, technology, product

design, outlook, trademarks, software, trade secrets,

images, sound records, pictures and etc. The Group

possesses the patent, copyright and trademark and

related rights, or obtain the authorization in legitimate

ways. They are protected by international treaties about

intellectual property. Without the permission of the

Group, other parties cannot possess, use, reproduce,

record or display any related intellectual property which

belongs to the Group. Otherwise the Group will consider

to take legal actions.

Data Protection and

Privacy Policies

In order to gain trust from our stakeholders, the security

of their personal information is important to us. The

Group acknowledges the importance in handling the

personal information carefully.

The Group understands stakeholders use their personal

information for different purpose. Therefore, it is

important for us to handle this information with care. To

protect this information from any unauthorised access,

accidental loss and destruction, the Group adopts

appropriate security measures in the transfer and storage

of the personal data.

Anti-Corruption

The Group places emphasis on ensuring all business is

conducted in accordance with relevant local laws and

regulations, with policies in place to safeguard against

corruption activities. Such measures are preventive,

detective and punitive in nature.

Policies include:

•

Code of conduct, which covers conflict of interests and

acceptance of advantages / benefits

•

Whistle-blowing policy

•

Entertainment policy

•

Travel policy

Environmental, Social and Governance Report

Community Involvement

The Group is resolved to cultivate good relationships

and focusing on needy areas within the community.

The BOEVx Social Service Team has enjoyed a successful

partnership with ELCHK Sheung Tak Integrated Youth

Service Centre (“Sheung Tak”) since 2013, serving

youngsters from ethnic groups such as Indians and

Pakistanis.

In 2017, the BOEVx Social Service Team engaged

in a new mentorship programme themed “Family

Assistance”. Family support plays an important role for

the growth development of youngsters. Volunteers and

ethnic families established a trust relationship. Volunteers

brought the families out of the community, expand

the network. Hence, the ethnic families could further

understand and make good use of the community

resources.

The project demanded a great deal of participation and

effort from the volunteers who guided the 6 ethnic

families throughout the process. A series of visitations

were provided by volunteers for the families to enhance

their understanding of Hong Kong, while the role of the

social workers of Sheung Tak were to organize Friday

support group activities every two weeks to provide

personal development, parental communications and

community information sharing to ethnic mothers.

The BOEVx Social Service Team cares deeply about the

development and prospects of this group of ethnic young

people and their family development. Looking into the

future, it is committed to implementing more programs

for the youth of ethnic minorities in a concerted effort

with Sheung Tak.

Awards and Accolades

It was an honour for the BOEVx Social Service Team to

be presented with “The 8th Hong Kong Outstanding

Corporate Citizenship Logo – Volunteer Category” by

the Hong Kong Productivity Council in 2017.

The Group provided sustainability in the community

services. It will continue to encourage employees and

their families to take part in the Group’s social service

activities, and we anticipate the BOEVx Social Service

Team will expand on its own strengths and achieve

continuous improvement.

Participation in Charity and

Work-Life Balance Activities

The Group is involved in a variety of events that combine

charity and sports. In 2017, the Group sponsored

colleagues to participate in:

•

Hong Kong Streetathon @ Kowloon

•

Standard Chartered Marathon

•

Oxfam Trailwalker

•

Heyuan International Marathon

The Group encourages work-life balance, yoga classes

were organised in the Hong Kong office and Chengdu

plant to encourage healthy living, and attracted many

colleagues to join, which enhanced the cohesion of

the Group.

Scholarship

Board of Directors and

Senior Management

DIRECTOR’S BIOGRAPHICAL INFORMATION

aged 41, was appointed as an Executive Director and the Chairman of the Company in April 2016. Mr. Yao is the chairman of the Nomination Committee and a member of the Remuneration Committee of the Company. Mr. Yao graduated from Beijing Technology and Business University with a master degree in management. He is a China Certified Public Accountant. Since 2001, Mr. Yao has worked as the head of the finance department, a finance director and the head of corporate planning center, the chief strategy officer, a director and an associate chief executive officer of the smart system business group of BOE Technology Group Co., Ltd (“BOE”), a deputy finance director of Beijing BOE Optoelectronics Technology Co., Ltd. (a subsidiary of BOE) and a finance director of Hefei BOE Optoelectronics Technology Co., Ltd. (a subsidiary of BOE). Mr. Yao is a member of the executive committee of BOE, a senior vice president, a joint chief operating officer and the chief executive officer of the smart system business group of BOE. Mr. Yao is also a president of BOE Optoelectronics Technology Co., Ltd., Beijing BOE Vision-electronic Technology Co., Ltd., Beijing BOE Multimedia Science & Technology Co., Ltd. and Beijing Intelligence Science & Technology Co., Ltd.

aged 38, was appointed as an Executive Director and the Chief Financial Officer of the Company in October 2014. Ms. Ko was also appointed as the Chief Executive Officer of the Company in March 2015 and was redesignated to a Co-chief Executive Officer of the Company in April 2016. Ms. Ko is a member of the Remuneration Committee of the Company and a director of various subsidiaries of the Group. Ms. Ko holds a Bachelor Degree in Economics and Mathematics from Mount Holyoke College, U.S.A., and a Master Degree in Finance from the Imperial College, London. She has over

7 years of experience in banking and has extensive experience in the securities and capital markets, and was a director of global markets — structured credit and fund solutions of HSBC until August 2009. Before joining HSBC, Ms. Ko served at Morgan Stanley (Hong Kong) and JP Morgan Securities Limited (London). Ms. Ko is the daughter of Mr. Ko Chun Shun, Johnson who is a substantial shareholder of the Company.

aged 37, was appointed as an Executive Director and a Co-chief Executive Officer of the Company in April 2016. Mr. Su is a member of the Nomination Committee of the Company and a director of various subsidiaries of the Group. Mr. Su graduated from the Graduate School of Chinese Academy of Sciences with a master degree in engineering. Since 2005, Mr. Su has served as a deputy division chief in the module technical department, a deputy department head in the new application business department, the division chief, a deputy general manager in the application business department of Beijing BOE Optoelectronics Technology Co., Ltd. (a subsidiary of BOE). Mr. Su is the general manager of the application business department of Beijing BOE Display Technology Co., Ltd. (a subsidiary of BOE).

aged 39, was appointed as a Non-executive Director of the Company in April 2016. Ms. Yang graduated from The University of International Business and Economics with a master degree in business administration. She has 15 years of experience in financial management. Since joining BOE Group in 2002, Ms. Yang has acted as the head of financial planning department, the head of accounting and taxation centre and the head of budgeting centre of BOE. She is a vice president and a deputy financial controller of BOE. Ms. Yang is also a director or a supervisor of a number of subsidiaries of BOE.